Introduction

For over thirty years AccuNet has guided mid-sized businesses through selecting and implementing financial systems. Below we have distilled the guiding principles that AccuNet and our clients use in selecting their next ERP.

1. All-in-One

As much as possible, we strive to get all the core business processes required to run our enterprise from one software solution. If CRM, distribution, time and expense, document management, project management, or any other module are integrated, you reduce double entry, cut costs, streamline business processes, increase visibility, and unify the corporate structure. If a feature you need isn’t built into the core product, we look for ways to integrate it.

2. Unlimited Licensing

Per-user license costs take the enterprise out of enterprise resource planning. In selecting a business system, your goal is to push data entry to the person most responsible for the transaction, and push targeted reporting to all people who can act on it. A per-license cost forces value decisions rather than opening up access to improve and streamline business processes. Department managers and project managers should be getting dashboards and alerts that keep them up to date on key performance indicators. The entire purpose of an ERP system is to share valuable financial information beyond the four walls of the accounting department. Do not let licensing inhibit your productivity.

3. Microsoft SQL-Based

All ERP systems use a database and the clear winner for mid-sized businesses is Microsoft SQL, the most popular, the most widely supported by other software vendors, and it self-maintains. Knock-off versions of SQL like MySql and MongoDb that some publishers use lack performance, compatibility, and features. Oracle is a large database engine that is trying to push down into the mid-market. Oracle requires more maintenance, and often a full-time person just to maintain the database. Keep it simple and go with the market winner – stay with Microsoft on this one.

4. Universal Workflow Engine

Older financial systems often have a few hard-coded workflows, maybe a purchase order or timecard approval, but newer systems have a universal workflow engine. The power of this cannot be overstated. It allows you to codify business rules into your financial system. For example, you can set up workflows that allow certain users to create a new account, but the controller approves it before it can be used; or require approval for any expense over a particular amount. All the rules for how you do business are built-in, avoiding errors and reducing employee training.

5. Mobility

The workforce is changing, and many employees complete tasks and enter data on a mobile phone. Mobile access keeps employees connected and makes sense for approvals, alerts, and time/expense entry. Modern ERP systems should include a mobile solution in the price, not an extra per user charge.

6. Outlook Integration

If your ERP system integrates with Outlook, wide ranges of productivity tools are available. Outlook integration enables automatic e-mailing of invoices, timecard reminders, AP payment notifications, statements, and scheduled reports. If the software vendor is not using Outlook, they often try to use SQL mail or build their own e-mail engine, which we have seen fail repeatedly.

7. Own Your Data

It’s hard to believe, but with many cloud-based ERP systems, you do not own your data. If you have a billing dispute, the ERP publisher can hold your data hostage. Others will give you your data but in hundreds of Excel spreadsheets like COA master, vendor master, invoice transactions, credit transactions, payment transactions, etc. This means a major conversion project as you try to piece together your financial data. Software publishers often charge exorbitant fees for a dump of your data. Make sure you understand the legal language in your ERP vendor’s license agreement. You should be able to get a copy of your database in a relational database like SQL, which is much easier to move to another ERP system.

8. Dashboards, Queries, KPIs, and Alerts

Modern ERP systems come with these features, and they should be built-in and included in the cost of the system. They should also be simple enough that a power user can set them up. Examples are accounts or subaccounts added in the last 30 days, customers with balances over x days, projects within 80% percent of budget, revenue and cost for my department compared to budget, etc. The information varies by business and user, but they are the frequently asked questions in your organization, and the answer is presented in an easily consumable format.

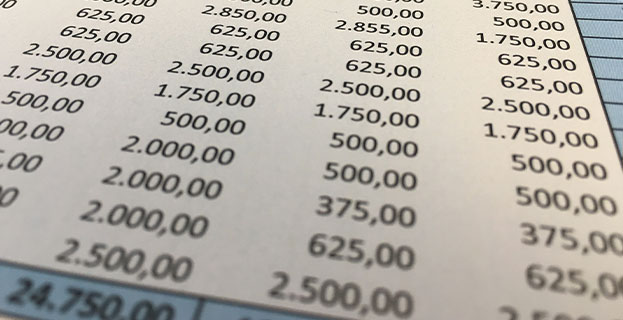

9. Excel-Based Financial Report Writer

AccuNet has worked with dozens of financial report writers, and all ERP systems have one. Most only report on GL detail, although some have drill down to AP or order transactions, which is good but not enough. The ideal financial report writer is Excel-based, always connected live to the database, has drilldown, and can pull budget and project information into financials. Think of projects with budgets rolling up to GL accounts with budgets, compared against the corporate budget. This is the holy grail of financial reporting.

10. Broad Third-Party Support

It’s crucial that your ERP system can integrate with other apps to meet your specific needs while still attaining requirement 1 (all in one place). An open ERP system will have a SQL database, published API’s (application program interfaces), open-source code, and include strong import/export features to every data entry screen. A respectable number of third-party apps is in the hundreds and often nears one thousand. You will see integrations from Microsoft like Office, SharePoint, Power BI, and Skype; major payroll systems like ADP; credit card companies; DocuSign; Dropbox; specialized shipping systems, etc. If you have unique industry solutions that must stay in place, find out if integration is available before making a decision.